PHILOSOPHY & YOUR MONEY

….Whether you are a top Forbes investor, Global company with thousands of employees, or just a hardworking immigrant sending money home - with PayRay you are the final authority and decision maker over hard earned paycheck.

The PayRay solution returns to the roots - when the banks were trusted deliverer and custodian partner.

ADVANTAGES OF BEING FIRST

The PayRay hybrid universal solution sends back in time the necessity to use SWIFT as the only inter-banking messenger.

Though, responsible banking still plays an important part of PayRay integrity and transparency when servicing the business between people P2P and companies B2B.

The hybrid PayRay portal enables both centralized and decentralized systems independently bridge conventional banking to a blockchain generation.

Thus, paving a new stratum for an old fashion way to become the only way. Where trust and respect for privacy - no compromise for secured transparency are the LAW.

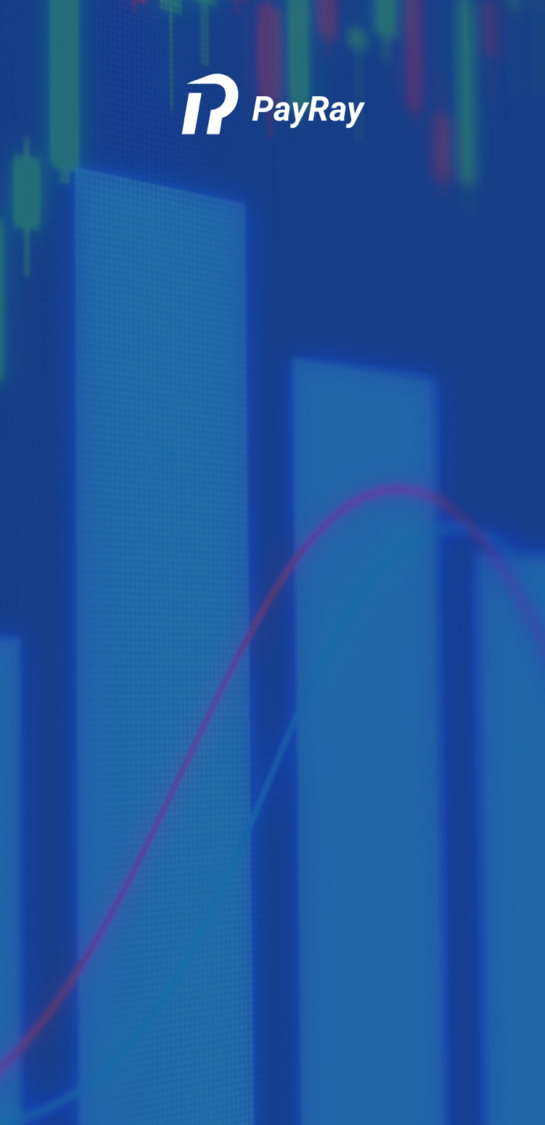

HOW IT WORKS

The PayRay “account-sharing” principle makes possible for a classic bank accounts to become a “Paymaster” account – cashing out stable coins (crypto tokens) for authorized beneficiaries. Such a solution constitutes a hybrid interface portal for centralized global banking community to interact with decentralized crypto dimensions powered by blockchain.

By injecting the blockchain into the centralized banking backyard – creates a digital path to access the Paymaster account sharing, whereby the receiver now is self-governed having the PayRay stable coin as the unit of exchange for goods and services or back to cash money.

The client’s data is kept in decentralized blockchain, therefore ultimately secured from any unauthorized entry or infringements. The exchange - buyback of Stable Coin wallet vs Fiat Account Sharing are realized on the basis of conventional processing and acquiring cross-border settlements in the global centralized banking system.

SIMPLICITY & ECONOMY

It is the Pay Ray signature hybrid solution that makes it possible for the sender and beneficiary to interact and trade places transferring cross-border: fiat to fiat, fiat to crypto, crypto to fiat, crypto to crypto globally 24/7 by a a few clicks on your PayRay mobile apps.

Additionally, the PayRay hybrid solution enables to secure a chosen currency at a zero inflation factor, free of time evolved between the points “send and receive”.

Because of the transaction cycles are mostly automated and digitalized coupled with low system maintains, it made possible to pass on the economy onto an end-user.

NOTE

Again, what makes it all possible, is the hybrid PAYRAY portal that enables both centralized and decentralized systems independently bridge conventual banking to a blockchain generation. Paving a new stratum for an old fashion way to become the only way. Where trust and respect to privacy - no compromise to security or transparency are the LAW.

NOTE

Again, what makes it all possible, is the hybrid PAYRAY portal that enables both centralized and decentralized systems independently bridge conventual banking to a blockchain generation. Paving a new stratum for an old fashion way to become the only way. Where trust and respect to privacy - no compromise to security or transparency are the LAW.

WORLD STATS - VOLUME OF MIGRANTS’ “MONEY HOME” REMITTANCE

Western Union, VISA/MasterCard, Golden Grown, Thomas Cook, MoneyGram and thousands of other smaller companies

- Eastern Europe – US $85 billion

- Western Europe – US $150 billion

- EurAsEC – US $78 billion

- Asia (China, India) – more than US $325 billion

- South-East Asia (Philippines, Indonesia, Malaysia) – US $35 billion

- North Africa, Morocco, Tunisia, Egypt – US $215 billion

- South Africa – US $42 billion

- Latin America, Mexico – more than US $215 billion

TOTAL: Over US$1.145 trillion and growing

TARGETED MARKETS AND REVENUES

India, Singapore, Indonesia, Thailand, Malaysia, Vietnam, Philippines, most African countries and Mexico. CIS and former Warsaw Bloc countries, combined have posted over One Trillion dollars cash funds yearly remitted to – from and between them.

On the face of a constantly growing market demand for secure and confidential, economically sound and politically non biased - currency agnostic ways to transfer and exchange money for goods and services, - it will be safe to say; the PayRay solution stands heads and shoulders above any current world operators.

Our conservative estimate for the year 2020 with only 0.03% penetration of the market share, will generate $30 million in gross revenue.

Considering that PayRay dept-free structure with low cost maintains, the profit margins pretax and banking fees are expected to be in the vicinity of 30% or better.

KEY CONTACTS

Nick Ogransky

Founder & CEO

PayRay Global

Financial Visionary

Founder of “World Without Borders”

Nick@payray.global

Konstantin Sadakov

Co-Founder & CFO

PayRay Global

Investment Banking Specialist

Konstantin@payray.global

Kira Pecherska

Co-Founder & Managing Director

PayRay Global

FinTech Global Srategies

Business Development- Asia Pacific

Oxford Alumna

Kira@payray.global

Ella Tsartsidou

COO

PayRay Mediterranean

Senior Partner, Business Development

Info@payray.global